In the United States, manufactured homes are popular because they are less expensive than typical real estate dwellings.

According to the U.S. Census Bureau, there are more than eight million manufactured homes in the United States, with the average cost of the purchase in 2021 being $88,000.

Even though mobile homes are less expensive than permanemajont residences, they are not cheap. To purchase a mobile home, you’ll require a substantial sum of money.

Buying manufactured homes can be a daunting, if not downright terrifying undertaking. Your credit score is one of the most important criteria that will influence financing. The cost of buying a mobile home is majorly determined by how good or bad your credit score is.

What Credit Score is Needed to Buy a Mobile Home?

Typically, to buy a manufactured home, most lenders want a minimum credit score of 580 to 620. However, not everyone in the United States has strong credit, which could be a huge concern when asking for mobile home loans.

Is it possible to buy a mobile home with bad credit? Simple answer…Yes!

With that said, repairing or building credit scores takes time. The good news is that purchasing a manufactured home might be an excellent method to improve your score.

Mobile homes are generally less expensive than typical site-built homes, making them a fantastic place to start rebuilding your credit.

Do Credit Scores Matter When Buying a Mobile Home?

When you buy a manufactured home, your credit score is important. When you apply for manufactured home loans, the lender will run your credit report to check your score and history through companies like Equifax and TransUnion.

Based on your reports, if the lender determines that you are a high-risk borrower, you will most likely be denied a manufactured home loan, or offered one with a high-interest rate.

Your cost of purchasing a mobile home will be substantially higher if you take out a loan with a high-interest rate rather than if you take out a mobile home loan with a low-interest rate.

Even though a solid score is important in obtaining financing for your manufactured home, you can still obtain a reasonable manufactured home loan and realize your American goal of homeownership.

Financing a Manufactured Home

Even if you have a low score, there are several financing solutions available to you. All you need to know is which one to choose.

For that to happen, you’ll need to do some digging to find out such information.

FHA Loans

To qualify for an FHA manufactured home loan, you must show that the manufactured home will be your primary residence. With this option, you can receive a loan to finance your modular homes even if your score is as low as 500.

You should be aware that the Federal Housing Administration does not make mobile home loans directly to borrowers; rather, it guarantees the bank to protect the loans from default. Submit your application to a financial organization such as a credit union.

You can acquire a FHA loan with as little as a 3.5 percent down payment. The good news about FHA loans is that the interest rates are fixed for the life of the loan, which in the case of mobile homes and manufactured homes is about 20 years.

The FHA maximum loan amount for a single manufactured home is $66,678, while the maximum loan amount for a manufactured home plus the lot it sits on is $92,904.

In addition, if you already own a manufactured home and want to acquire a lot, the maximum FHA manufactured home loan you may earn is $23,226.

FHA Title II loans are meant for real estate. As such, purchasing land will make you eligible.

While a score of less than 640 may qualify you for an FHA loan, you should expect to pay a higher interest rate as a result.

If you’re in a financial bind, nonprofits like InCharge Housing Counseling can help you improve your credit and establish if you’re eligible for down payment assistance.

VA Loans

Loans from the Veterans Administration are intended for servicemen and women who have served in the military, and the surviving spouses. If you have previously served in the military, a VA loan is likely one of your best choices.

With that said, you should be aware that being a veteran does not guarantee you a loan because other variables will affect granting you a loan. Your assets, credit history, and employment history, for example, will all be scrutinized.

For Veteran Administration (VA) loans, a minimum down payment of 5% is required.

If you buy mobile homes with their lot, it must be your primary residence.

Chattel Loans

A chattel loan is a personal property loan (movable personal property). As such, you can use it to finance a manufactured home or an automobile.

The car acquired can be used as the loan’s collateral, or simply it insures the loan.

You must be aware that chattel loans often carry a significant interest rate compared to other types of loans. As such, expect to have higher monthly payments.

USDA Loans

Also known as the Rural Development loan, USDA manufactured home financing is accessible to some rural homebuyers.

The upside of applying for a USDA loan is that you will pay no down payment as a requirement. Even though there’s a not set minimum credit score, a score of at least 640 is recommended.

USDA mobile home loans, on the other hand, do have their drawbacks. For example, a 2% guarantee fee is applied to the loan amount, and to make matters worse, you’ll also be charged a 5% yearly fee, which is added to your monthly payments.

Even while the interest rate varies, it is often lower than that of conventional loans.

In addition, for you to qualify, your manufactured home must meet the geographical requirement by the USDA. Luckily, the majority of the American landmass meet the requirement.

Another USDA loan criterion fits that your income does not exceed 115 percent of the national median. Furthermore, unlike traditional mortgages, you will be rejected if you earn too much money.

Always ask your bank or credit union whether they can assist you with a USDA mobile home loan application.

Loan Terms for a Low Credit Score

Loan terms are the conditions that a lender will impose on a loan that you take out. The interest rate you will pay, for example, or the amount of a down payment you will be required to make will be determined by the lender.

A lender may request a down payment of 5%, 10%, or even 20% as a way to cover the loan in the event that the borrower defaults. A higher interest rate indicates that you are a high credit risk, and the lender wants to get the money back as soon as possible.

As previously said, your credit score is critical to mobile home loan acceptance, but other variables, such as financial history, will also influence the choice.

Should I Fix My Credit Score Before Shopping for a Manufactured Home?

A poor credit score will lower your chances of getting a mortgage, and that’s why it’s important to maintain a good financial history. If you don’t meet the minimum credit score, consider repairing your credit.

Whether or not you should repair your credit before purchasing a mobile home is a personal decision. It is possible to reduce your monthly rent cost if you make higher monthly rent payments. If that’s the case, think about improving or rebuilding your credit before looking for a mobile home.

A credit score takes years to build, and one of the most important factors is your charges, which you must never default on or even pay late. Any debt that your lender has charged off may be sent to one of the major debt collection agencies in the US.

If you have bills to pay, create a reminder and make sure you pay them on time to keep your credit score from plunging.

Even if you can buy a mobile home with terrible credit, the cost is typically high; therefore, consider improving your credit score before shopping for one if you aren’t in a hurry to get home.

What Does Credit Score Represent?

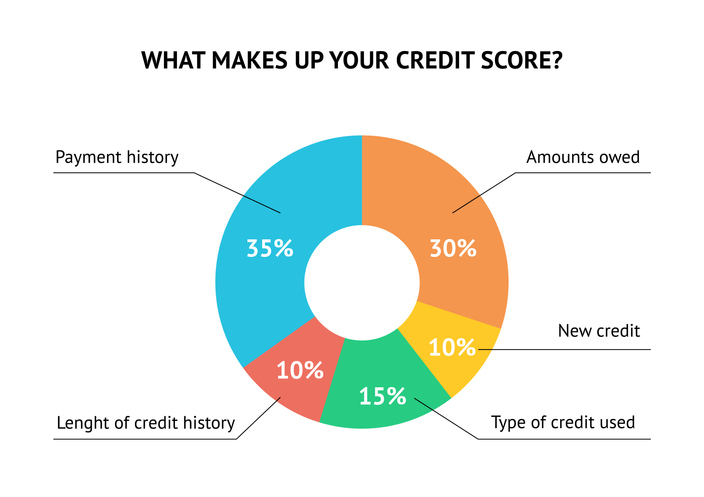

A credit score represents a number of activities in your credit history, which includes:

- The total amount of debt

- Timeliness of payments

- Percentage of credit being used on an account, and many more

Ways to Improve Your Credit in Order to Purchase a Manufactured Home

You may require a mortgage to purchase your next manufactured home, and doing so exposes you to a great deal of credit scrutiny from lenders.

As a result, if your credit score is low, you’ll have to spend a lot of money on interest.

A low credit score can often imply that you’re merely going to default on your loan payment. Building your credit history will help you lower your risk and increase your chances of getting better loan terms.

So how do you go about doing that?

There are a few things you may do to raise your credit score:

● Boost Your Payment Track Record

● Use the Services of a Credit Repair Company

● Getting Rid of Credit Card Debt

● Examine and Correct Your Credit Reports

● Request Rapid Rescoring

● Do Not Create Any New Credit Accounts

● Prequalify Online and Compare Interest Rates

Boost Your Payment Track Record

Your credit score is determined in part by your payment history, which accounts for 35% of your total. As a result, you should always pay your bills on time; because even one late payment can cause your credit to suffer. Remember, credit restoration takes time.

Do you know how long it takes to remove a negative credit record from your credit report?

Seven years needs to pass! Isn’t that a long time to acquire a mobile home?

So, rather than waiting seven years for your credit score to rise, make arrangements for your monthly payment.

Consider all of your monthly bills, including power, phone, water, garbage, internet, auto loans, personal loans, student loans, and medical expenditures, in addition to your credit card.

It’s common for situations to arise that affect your monthly bill. If this happens, contact your service provider and inform them.

Use the Services of a Credit Repair Company

Because repairing credit scores might be difficult, you should seek the assistance of a credit repair company.

A credit repair business can assist you in dealing with the bad aspects of your credit history. The disadvantage is that you will be charged for the company’s services.

Expect to pay anywhere from $79 to $99 per month, for example. The final cost of your repair will usually be determined by the complexity of the eros on your report. Having said that, a credit report with fewer problems will normally cost less than one with many.

A credit repair firm cannot guarantee a rapid remedy, so don’t get your hopes up and assume you’ll be able to restore your bad credit suddenly.

Getting Rid of Credit Card Debt

The quantity of credit you’re using in relation to the amount of available credit is referred to as credit use. A low credit utilization ratio indicates that you are a financially prudent person.

If you go overboard with your expenditures, you’re more likely to fall behind on your bills. With that being said, it’s critical not to use up all of your allotted credit.

Using 20-30% of your credit limit is often deemed acceptable. If you owe money on a credit card, consider paying it off to raise your credit score.

If you’re thinking about buying manufactured homes, don’t use your credit card excessively; this could signal that you rely on your credit card for all of your monthly expenses. As a result, if you have other ways to reduce your payment, think about utilizing them instead of your credit cards.

Before offering a mortgage, lenders will be concerned about your debt to income ratio. Your chances of securing a mortgage are slim if you have an uneven debt to income ratio.

Examine and Correct Your Credit Reports

Checking your reports is important to keep unnecessary errors from harming your score. For example, there could be incorrect accounts, incorrect payment statuses, among other common errors. You must get rid of these errors once you notice them.

File a dispute with the credit reporting bureau if you discover an inaccuracy. You will not be charged anything if you submit a dispute with the credit reporting bureau.

Filling out a dispute form isn’t difficult; simply draft a letter outlining the specifics of each of the faults you found. Include any copies of evidence you have to back up your claim.

It may take up to 30 days for the bureau to review your claims and respond. If there was a mistake, it will be corrected.

As a result, consider sending a copy of your report to your previous creditors to keep it up to date.

Request Rapid Rescoring

Rapid rescoring can assist you in removing inaccuracies from your credit reports.

A lender and a company specializing in rapid rescoring can assist you in reporting the information to credit bureaus and resolve the issue in five business days, rather than months.

Do Not Create Any New Credit Accounts

You should be warned that too many inquiries can harm your credit score. As a result, opening a new account shortly before purchasing a mobile home is not recommended.

Prequalify Online and Compare Interest Rates

Prequalification for a loan can assist you in assessing your creditworthiness based on your credit, debt, income, and assets.

The prequalification calculator will tell you how much money you can borrow, your monthly mortgage payment, and the highest monthly mortgage payment you can acquire.

You can use the estimations to negotiate better conditions and decide whether you want to make a bigger down payment in exchange for a lower interest rate.

Is Buying a Mobile Home a Good Idea?

A mobile home, just like any other housing option, has its pros and cons.

Generally, mobile homes are inexpensive compared to their counterparts, site-built homes. In fact, mobile or manufactured homes can be up to 30 percent cheaper than traditional homes.

You must, however, determine whether you want a mobile home on a private lot or in a manufactured home community or mobile home park before purchasing one.

Consider yourself a “tenant” if you don’t own the land because you’ll be paying a lot of rent to a landlord.

Mobile home parks generally charge lower rent than apartments available for rent. As such, you’re better off if you buy a mobile home and pay the mortgage.

Mobile and manufactured homes feature single wide, double wide, and triple wide floor plans.

Always remember to compare lenders before settling on one for your mortgage.

Final Thought

With a credit score of 500, you can get a mobile home. However, improving your credit score before purchasing a home is an excellent idea.

You have a better chance of getting a better loan term (lower down payments and interest rates) if you have a higher credit score.

If you don’t meet the minimum credit scores, consider repairing your credit.

A personal loan, FHA mortgage, or VA loan, among other options, can be used to finance your modular homes.

You’re more likely to qualify for traditional mortgages if your mobile home is permanently tied to the land.

Consider additional financing options with better loan conditions if a personal loan isn’t enough to cover the purchase price.